30+ Online depreciation calculator

Enter the value that you want to calculate depreciation. Periodic straight line depreciation Asset cost - Salvage value Useful life.

Where To Find Affordable Rents Across Canada Via Zoocasa Featuring Ren One Bedroom Apartment Rent Infographic

Annual expense OC - RV t.

. The calculator uses the following formulae. Unit of Production Depreciation Formula. It provides a couple different methods of depreciation.

It includes support for qualified and listed assets including motor. Annual depreciation amount Original cost of asset - Salvage valuenumber of periods. Depreciation Amount Asset Value x Annual Percentage.

The Good Calculators Depreciation Calculators are specially programmed so that they can be used on a variety of browsers as well as mobile and tablet. An asset has original cost of 1000 and salvage value of. This depreciation calculator is for calculating the depreciation schedule of an asset.

Per unit depreciation formula has. To understand the unit of production depreciation formula better we will break it down into two parts. The algorithm behind this straight line depreciation calculator uses the SLN formula as it is explained below.

Balance Asset Value - Depreciation Value. Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost1Life Variable Declining Balance Depreciation. There are many variables which can affect an items life expectancy that should be taken into consideration when determining actual cash.

Calculate depreciation by straight line depreciation method. The formula for calculating three methods of depreciation is as follows. This MACRS Depreciation Calculator supports nearly all the nuances and conventions of the Internal Revenue Code.

Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the beginning of the year 3. Straight Line Depreciation Rate Straight Line DepreciationCost of Asset x 100 The underlying assumption of this. Yearly Depreciation Value remaining lifespan.

You may also be interested in our. Straight Line Depreciation Cost of Asset Scrap ValueUseful life. First one can choose the straight line method of.

The calculation formula is. The calculator should be used as a general guide only. Straight Line Depreciation Calculator Reducing Balance Method Depreciation Calculator.

List Of 30 Best Accounting Software For Small Businesses In 2022

Logical Functions In Excel And Or Xor And Not

Florida Appraisal Continuing Education License Renewal Mckissock Learning

Macrs Depreciation Calculator Based On Irs Publication 946

Wevj Free Full Text Configuration Of Electric Vehicles For Specific Applications From A Holistic Perspective Html

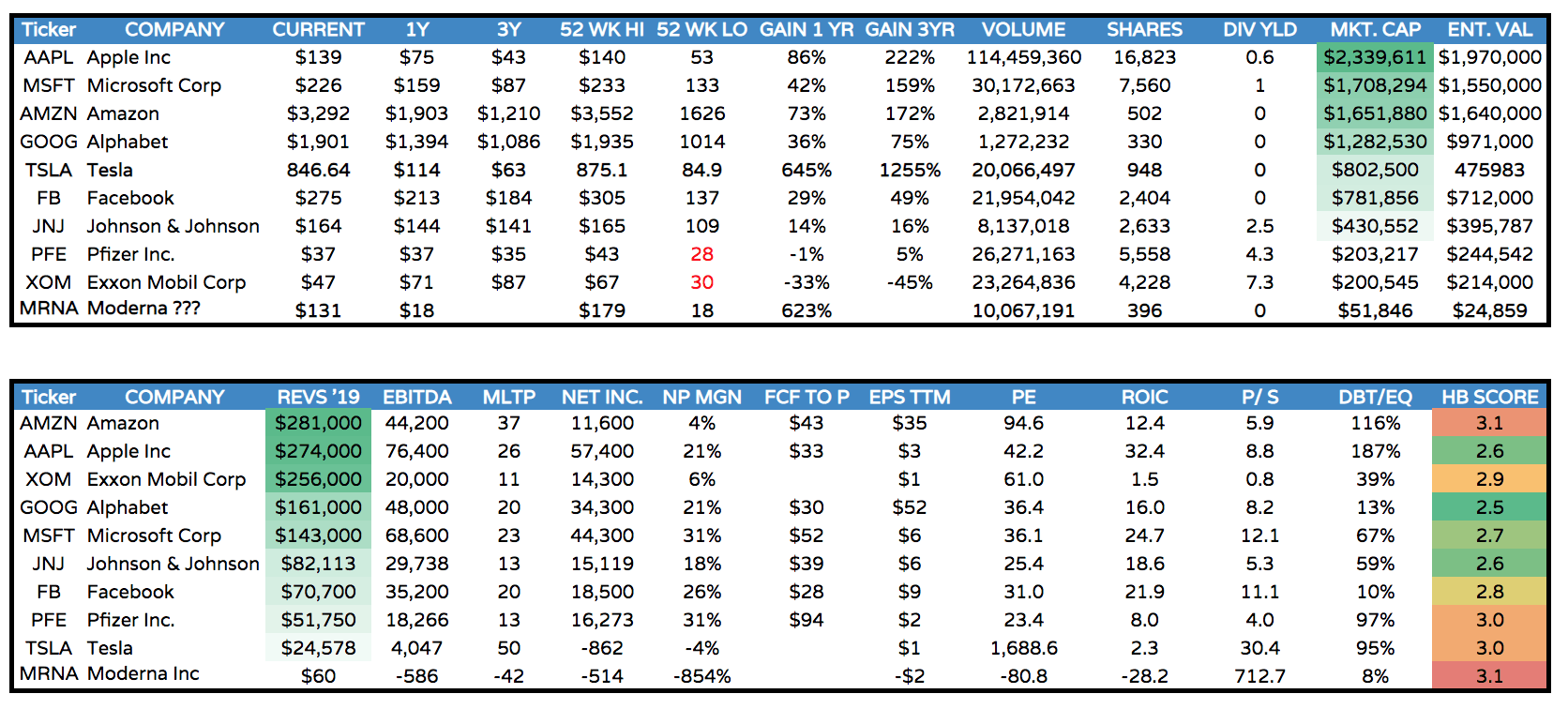

Moderna Shockingly Undervalued Can Be The First Healthcare Technology Giant Nasdaq Mrna Seeking Alpha

11 Real Ways To Increase Your Income In 30 Days Or Less

Category Insights Mercer Capital

Income Statement Example Template Format Income Statement Statement Template Business Template

1 Replacement Problem In Operations Research When Constant Resale Value Is Given By Kauserwise Youtube

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Cade Ex991 149 Pptx Htm

Cade Ex991 149 Pptx Htm

Ecommerce Accounting Income Statements P L 101 Amaka

Excel Trendline Types Equations And Formulas

Rrd Ex991 251 Pptx Htm

Rrd Ex991 251 Pptx Htm